Annuity with inflation formula

Securities and Exchange Commission the real rate is the true economic benefit offered by an investment after taking into account taxes and inflation. The annuity payment formula can be determined by rearranging the PV of annuity formula.

Annuity Due Formula Example With Excel Template

The calculation of an annuity follows a formula.

. Fixed index annuities and variable annuities with lifetime income riders are two types of annuities that offer protection against inflation. Which Annuity Hedges Against Inflation. Even a low rate of inflation can significantly erode purchasing power in the long run.

Dont Buy An Annuity Until You Review Our Top Picks For 2022. The primary risk of most annuity payouts therefore is inflation. This can be further.

Inflation-Protected Annuity - IPA. P Present value of your. In words at the start of next year the investment is P 1I and the return less the increased payout of p 1I leaves an investment of P 1I2 for the following year.

After rearranging the formula to solve for P the formula would become. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. Ad Learn More about How Annuities Work from Fidelity.

11 Little-Know Tips You Must Know Before Buying. Future Value of an Annuity C 1in - 1i where C is the regular payment i is the annual interest rate or discount rate in. 3841 yarbrough ave winston-salem nc 27106.

The real rate of return is the nominal return less the. On the other hand if the cash flow is to be received at the end of each period then the formula for the present value of an ordinary annuity can be expressed as shown below. An annuitys documentation states its anticipated average return rate or you can assume a rate equal to the Treasurys rate on risk.

FV Ordinary Annuity C 1 i n 1 i where. For example if the average annual inflation rate is 3 percent over the next 20 years it will cost you 181 to. Let I104 be the inflation rate and Y110 be the investment yield.

Guarantees apply to minimum income from an annuity. This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1. You can withdraw monthly.

If x is our initial payout then its present value is obviously just. According to the US. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where.

An annuity investment that guarantees a real rate of return at or above inflation. Theres actually a much simpler way to derive this formula. PVA Ordinary P.

Inflation is calculated using the formula given below Inflation CPI 2019 CPI 2018 CPI 2018 Inflation 12495 12017 12017 Inflation 398 Therefore Dylan found out that the rate. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Add 1 to the interest rate on the annuitys cash flows.

By using the geometric series formula the present value of a growing annuity will be shown as. Ad Learn More about How Annuities Work from Fidelity. Guarantees are based on the claims-paying ability of the issuing insurance company.

If your annuity pays a fixed 3000 per month for life and inflation increases 10 the buying power of your annuity. C cash flow per period i interest rate n number of payments beginaligned textFV_textOrdinaryAnnuity.

2

Real Interest Rate Formula Double Entry Bookkeeping

Present Value Of An Annuity How To Calculate Examples

Break Even Analysis Template Business Management Degree Startup Business Plan Template Analysis

Annuity Present Value Pv Formula And Calculator Excel Template

What Is An Annuity Table And How Do You Use One

Perpetuity In 2022 Economics Lessons Accounting And Finance Finance

Future Value Of Annuity Formula Annuity Formula Annuity Forex

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

Calculating Present And Future Value Of Annuities

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

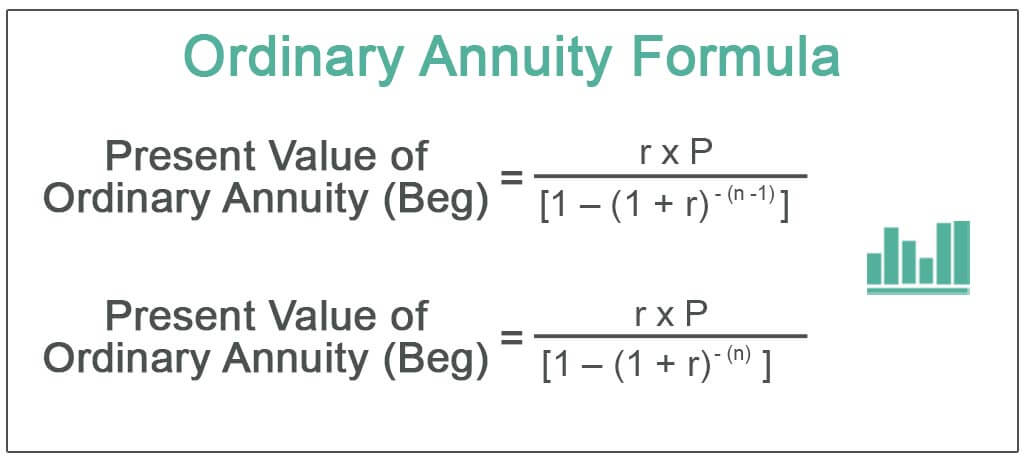

Ordinary Annuity Formula Step By Step Calculation

Present Value Of An Annuity How To Calculate Examples

Romans 5 8 9 Romans 5 Romans 5 8 Wrath

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Time Value Of Money Tvm Formula And Example Calculation

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

Calculating Present And Future Value Of Annuities

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition